By Hunter Satterfield, CPA

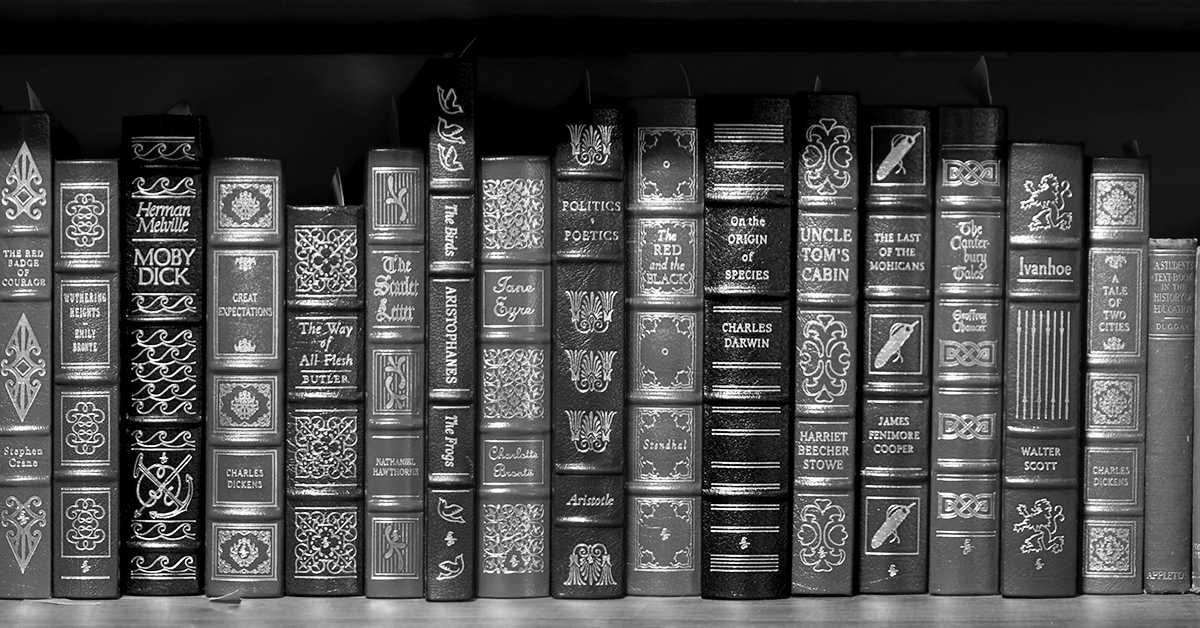

Several years ago, a client of mine told me that he was re-reading the ‘classics,’ because his thinking had evolved since first reading them in grammar school.

I took his advice and recently picked up “Great Expectations” by Charles Dickens – a story in which young Pip is granted a sizeable fortune from a wealthy benefactor. Reading it with my current adult perspective allowed me to identify and ponder Dickens’ question I most likely overlooked as an adolescent: what is the impact that wealth can have upon a person? This is a complex topic and one that I find myself discussing with clients constantly.

This same topic also arises in the book “The Geometry of Wealth,” by Brian Portnoy. However, in trying to answer it, he takes a different approach from the typical personal finance or investing book. He is less focused on helping the reader maximize the amount of money sitting in stocks or bonds or real estate. Instead, Portnoy’s self-defined quest for the book is to connect meaning and money and to answer the question of how does money figure into a joyful life.

At the heart of his book is his definition for wealth: wealth is funded contentment. The heart of funded contentment is understanding what brings joy and happiness to a life. Portnoy posits that there are four enduring sources of a joyful life:

– Connection is the need to belong.

– Control is the need to direct one’s own destiny.

– Competence is the need to be good at something worthwhile.

– Context is the need for a purpose of

Like Pip, Portnoy makes the point that people who have more money are not necessarily happier, though some are. It’s generally agreed that those with wealth are often less sad, and understanding this makes the case that money – when spent wisely – makes a positive difference on one’s life. This is an incredibly healthy conversation to have about money, which most personal finance books do not address.

Portnoy suggests the first step for a person to have a healthy relationship with money is identifying what they want out of life. The process of earning, saving and investing money only serves to underwrite the purpose a person wants for their life, so it’s essential to identify and understand this purpose first.

Once Portnoy has broached this topic, he focuses on the process in which to obtain the wealth one would need to fund their contentment. Portnoy shows us the strategy on how to think about what matters, how to set priorities in your life, make meaningful decisions, think in probabilities and find a balance between more and enough.

He makes a compelling argument worth mentioning around protecting resources. He touches on the concept of risk versus reward in a way many authors have not—he argues the importance to “be less wrong” and challenges the traditional mantra that taking more risk results in more reward. Instead, Portnoy makes the argument that taking more risk “increases the variability of future outcomes.” This is a helpful concept and one that underlies many of the decisions we make in our financial lives from investing to debt to insurance.

At the end of “Great Expectations,” Pip reflects on his circumstances over the years and concludes that the money he sought didn’t bring the happiness he desired. Much of this was because Pip was too young when he received his great expectations to understand what he wanted in life. This is a conversation we have all had over the years and “A Geometry of Wealth” does an excellent job of shining a light on the elephant in the room and talking through both the happiness aspect and the actionable process investors undertake to build wealth.