How to maximize your deductions

Updated April 2025

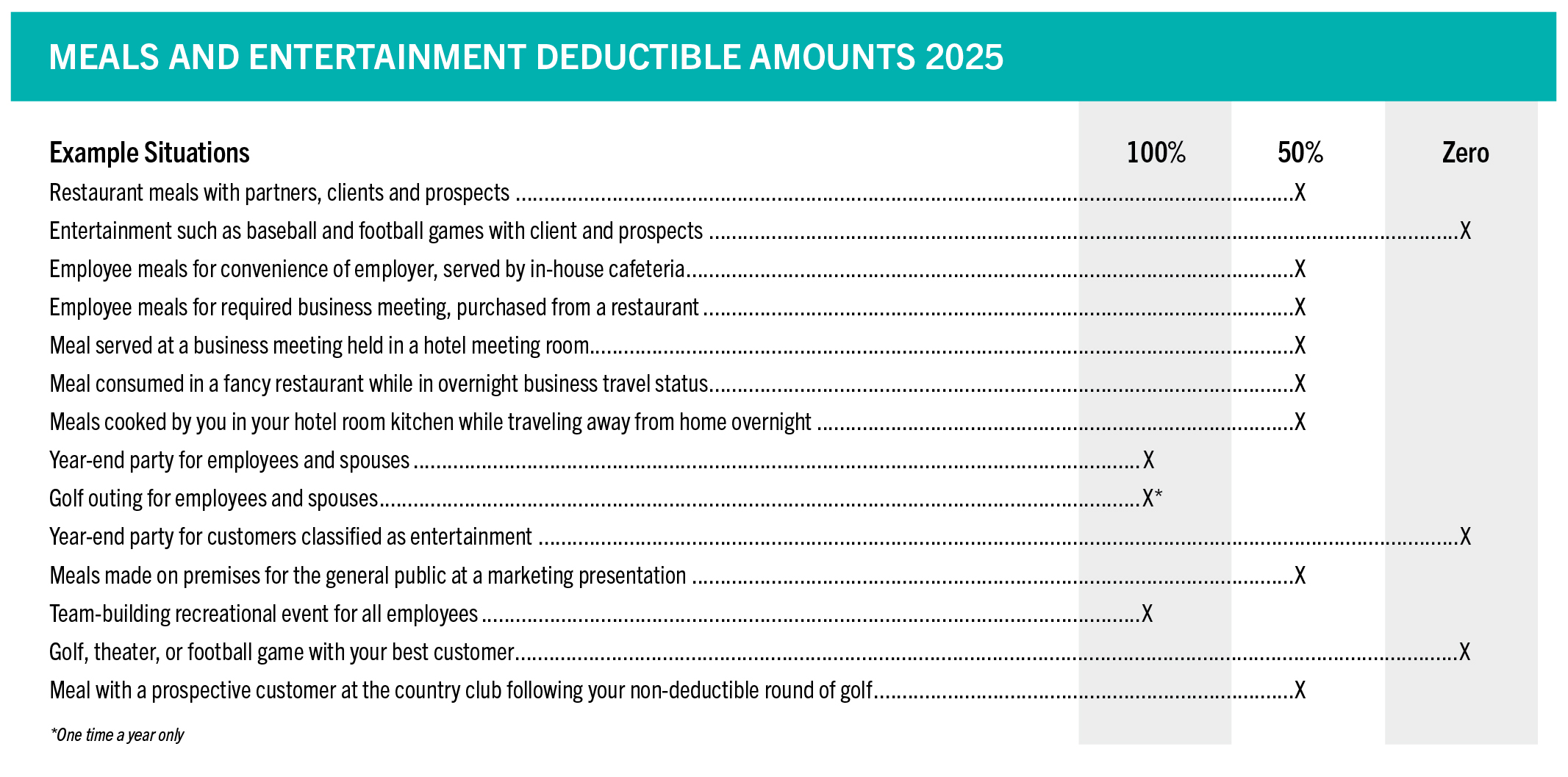

Understanding the expenses you can and cannot write off for your small-to-mid-sized business is critical for optimizing your financial strategy in 2025. The meals and entertainment tax deduction has been a valuable way for successful business owners to maximize their tax savings. However, because the rules can change and expenses can vary in terms of deductibility, business owners often have questions about this deduction.

If you remember the Consolidated Appropriations Act of 2021, you know this temporary rule allowed food and beverages purchased from a restaurant to be 100% deductible in 2021 and 2022. However, the Tax Cuts and Jobs Act (TCJA), enacted in December 2017, made a significant change by eliminating the deduction for most entertainment expenses starting in 2018. The TCJA also retained the 50% deduction for business meals, provided certain conditions are met.

In 2025, the rules surrounding meal and entertainment deductions stay the same as in 2024. To ensure your business stays compliant, Senior Tax Research Manager Yunnice Chang offers these reminders:

1. Business meals are still deductible. Meals related to business meetings are still 50% deductible. Dinner provided for employees working late is also 50% deductible. Although de minimis fringe benefits, such as in-office coffee and snacks, do not fall into the meal category, they are 50% deductible under the current tax rules. Starting in 2026, the deduction for de minimis fringe benefits, including in-office snacks and coffee, will be eliminated.

2. No entertainment deductions. Under the TCJA, buying tickets to take a business client to a sporting event or similar entertainment is not deductible. Also gone are charitable deductions for contributions to the right to buy tickets to a college’s athletic events. However, you can deduct the meals consumed at these events, provided the costs are itemized separately on the receipts.

Expenses primarily for the benefit of employees, such as team-building activities or a companywide party for employees, are 100% deductible.

“Team building outings are a great opportunity to take advantage of the 100% deduction,” said Yunnice. “This can even include entertainment elements like sporting event ticket purchases or other expenses associated with admission to similar activities.”

4. Record-keeping is key. Although your tax preparer may not need a copy of your dinner receipt, the IRS mandates that you keep a record of your receipts. Document who you were with, the purpose of the meal, and how it relates to your business in case of an audit.

If you have expenses abnormally higher than last year, this could be an area at risk for exposure to the IRS. Keeping documentation will help support an audit, should it happen. If you cannot substantiate your expenses, you will have to pay back the tax, penalties, and interest.

As tax laws continue to evolve, business owners should stay aware of any potential changes that could affect their bottom line. While there are no imminent changes on the horizon, future tax laws could affect how business owners manage meals and entertainment expenses.

Reducing your tax burden is essential to achieving long-term financial goals. Our in-house tax professionals play a vital role in helping our clients ensure they have explored all options to reduce any tax liabilities. To learn more about how our planning and tax teams can assist your practice, schedule a complimentary consultation.