Leverage these strategic tax environments to accumulate wealth faster

Key takeaways

- Better allocation of your money means you don’t have to make more money to have more money.

- Most business owners have an unnecessary amount of money going to taxes, not for lack of trying but for lack of knowledge.

- Taxpayers need to understand not only the various savings vehicles but how to structure them in the most tax advantageous way.

A strategic tax plan is one of the most critical steps to accumulating wealth. When our financial planners sit down with a new client for the first time, they typically spend a lot of time getting their existing distributions in order.

With inflation and costs rising in your home and your business, getting all the tax deductions you can feels more valuable than ever. Most individuals understand the different types of savings vehicles like 401(k), IRA, or 529 Plans, which can provide potential tax advantages depending on factors such as age, income levels, state of residence, etc.

What individuals may not know is when and how to get their income into these vehicles in the most tax-advantageous way. This is so important because ensuring your income, investments and debt are positioned in the most strategic tax environment can not only give you a head start in reaching your long-term goals but help you reach them faster.

Financial Planner Scott Clynch believes a greater understanding of this concept can empower clients to better understand how their financial plan works.

“The Five Tax Environments is the core concept that guides many of the personal and business recommendations I will make throughout the day with a client,” he said. “With their basic understanding of the categories, I can create strategies they understand and believe in, which save them a considerable amount of money while also reaching their goals in ways they had not considered.”

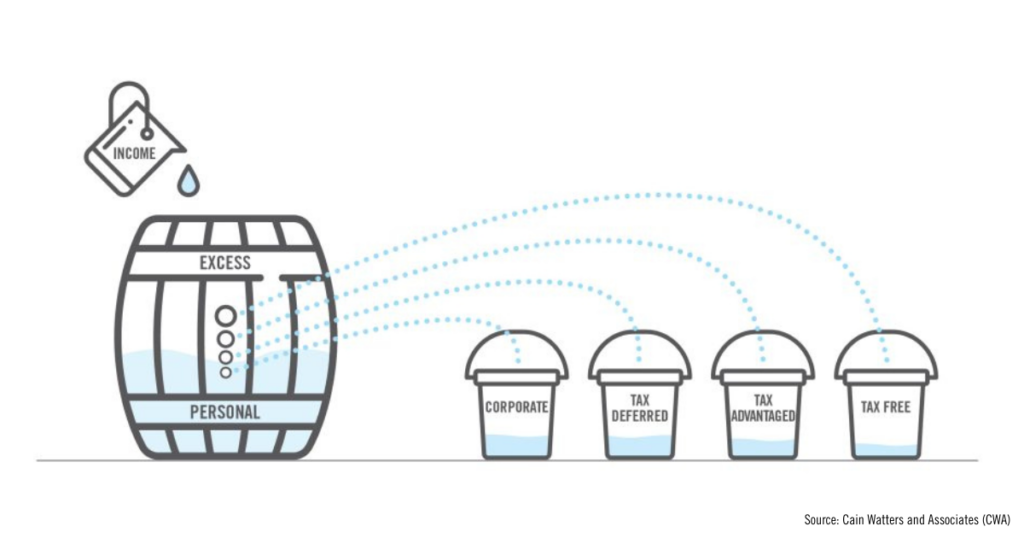

Scott visualizes the ideas of the different tax categories in a unique way. In illustrating the concept, he asks doctors to imagine a wooden barrel filled with water.

“The water inside this barrel is your income,” he says. “Imagine that there are holes drilled in the barrel. The smallest holes are at the bottom and get gradually larger as you move up. These holes represent the IRS tax brackets. If you leave all your income in this one barrel, it will leak—slowly from the bottom but more quickly as you continue to put more income into it.”

Water leaking from the income barrel is inevitable to some extent, as everyone must pay taxes. But, if you envision the tax environments as additional buckets, with no holes in them, that you can transfer some of your water to, they are now a strategy to allow you to retain more of your income.

The Five Tax Environments:

Personal

Without any action, all your income defaults here. This environment represents the main barrel. This is where each person spends the bulk of their money. The personal tax environment covers the income you need for basic human necessities like food, shelter, entertainment, and non-tax-deductible debt payments.

If you bring in more than that, the question then turns to how can you allocate that excess tax-efficiently so that it doesn’t unnecessarily leak—or go toward taxes.

Corporate

As a business owner, this is where you should start. You can fill this bucket by taking advantage of this environment with S-Corp, C-Corp or LLC perks and general corporate deductions like your cellphone, car, internet or other necessities you can run through the business. Once it is full to the extent the IRS allows, you should move on to the next bucket.

Tax Deferred

When it comes to saving for retirement, your money needs to be invested in the most tax-efficient manner first. Examples are pre-tax 401(k) contributions, SEP/SIMPLE plan contributions and defined benefit plans. Remember, these buckets are not bottomless; there are funding caps on each one. The IRS determines how much income you can defer in each program and can be based on a dollar amount or a percentage. It’s best to consult your CPA for your individual limits based on income level.

Tax Advantaged

Scott refers to these as the “no-brainers.” Home mortgage interest, charitable contributions, residential property taxes, and certain states with income tax payments all help reduce the tax burden. Although seemingly obvious, Scott reminds that it’s a good rule of thumb to ensure your CPA appropriately accounts for these items on your tax return.

Tax Free

The tax-free environment can be another supplemental savings tool if you still have leftover income. Examples are municipal investments, 529 plans, Health Savings Accounts, and Roth IRAs.

In certain instances where taxable income may be low due to age, starting or buying a practice, or tax-saving strategies implemented by an advisor, it may make sense to use this environment as a primary versus a supplemental tool. Consult your advisor for personal advice.

Although it’s never too late to get on the right path, Scott stresses the importance of saving income in these environments as early as possible. It’s not just knowing what each environment is, but also how, when and why it may be appropriate to transfer the income from one environment to another, especially when the economic landscape changes quickly. There are complexities to each situation, so it’s good to have financial professionals on your team.

“Far too often, business owners are not educated on the different opportunities each environment presents,” he said. “I’ve met clients who have been out of school for 10 years and still have an unnecessary amount of money going to taxes. Not for lack of trying—just for lack of knowledge.”

Better allocation of your money means that you don’t have to make more money to have more money to save. You can leverage your current income level without adding one additional production dollar and reallocate it into a more tax-efficient environment.

Today just feels different than it did five or 10 years ago. Scott reminds, “Things are more expensive, and your dollars are not going as far. You must take advantage of tax deductions, or what I jokingly call ‘government mail-in rebates’ to maximize your earnings in today’s economic environment.”

Through the years, we’ve seen how these things have evolved —tax reform in 2017, COVID legislation, the SECURE Act and SECURE Act 2.0. The economic environments are ever-changing and full of moving targets that can change quickly over time. That’s why it’s essential to work with a CPA who can work to ensure you are maximizing these buckets, not just today but with every single legislative change.

Is water leaking too quickly from your income barrel? Reach out to our CWA team—we’ll bring the buckets.