Retirement planning is not just for the person approaching it – it is something that everyone needs to focus on at every age. You should start formulating your plan and saving towards that goal as soon as you bring in that first paycheck.

CWA’s philosophy for retirement savings stems from the 50/30/20 rule. It’s our quick and easy guideline to evaluate the three main categories where your money needs to go each month. Each of the three numbers are a percentage of your total income:

– 50 percent: represents the amount of your lifestyle spending and debt payments

– 30 percent: represents the amount you pay in taxes including federal, state and payroll taxes

– 20 percent: represents your savings, including retirement savings as well as personal and college savings

That’s right, a complete 20 percent should go to savings.

We know you have bills to pay. You are still paying off student loans, you just signed on the dotted line on your new mortgage. The responsibilities of life have a funny way of stacking up quickly. Focusing your saving for a goal that is well over 30 years away can move pretty far down on your list.

Actively saving may seem daunting, but it is important. As a dental professional, you know your work matters to the patients you help and serve every day; but what about you? Will your practice be working for you – when you are no longer working?

The 50/30/20 formula, combined with strategic savings investments, can help you maintain your current standard of living in retirement—this, essentially, is the ultimate retirement goal of most people.

But, how could 20% of your check turn into a full check in retirement? The power of compounding interest.

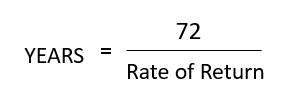

To illustrate this concept, let’s look at the Rule of 72—a common tool used by financial planners as a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest.

If you divide the number 72 by your annual investment rate of return, the result is equivalent to how many years it will take for your investment to double.

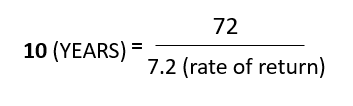

Based on the Rule of 72, if we assume your investments are receiving a 7.2% rate of return, your money would double every 10 years.

Let’s assume you are an associate making $150,000 this year. You save your 20% of your total income, which equals $30,000. If you work for 35 years, your money will double three and a half times. Doubling $30,000 three and a half times results in $360,000 of accumulated wealth. Which means, the decision to not save this year only, is now not just a $30,000 decision, but rather a cumulative total decision of $360,000—based on only one year of savings alone. Imagine what that number would be if you missed a few more years.

Getting your money to work for you starts with actionable items. Here our top 3 things your retirement plan needs today:

1. Save 20% of your income starting now.

Difficult at first yes, but it can be done. CWA Partner Judson Crawford suggests taking it off the top, right away.

“Treat your savings, just as you would treat any other bill” he said. “You always pay your creditors, and paying yourself should be just as important. In addition, you cannot spend what you do not have, so if you remove the money as soon as it comes in, you remove the temptation of spending.”

2. Put your money in a tax deductible or tax free environment. There are two types to consider, a healthy mix of both is appropriate.

Before-tax (tax deferred): This means that the savings amount is tax deductible now, the growth is tax free and you only pay taxes upon withdrawal. Examples are an employer sponsored pension plan, or a traditional IRA.

Tax Free: These are contributions that are not tax-deductible, however the growth is tax free and the eligible distributions are tax-free. Meaning, you contribute with after-tax dollars, but as the account grows, you do not face any taxes on capital gains, and when you retire, you can withdraw from the account without incurring any income taxes on your withdrawals. Examples are a Roth IRA, Roth 401(k), or a Backdoor Roth.

The tax-free nature of the Roth environment is a huge advantage, especially if you have a good amount of time for the assets to grow.

“I generally recommend maximizing Roth savings opportunities, unless paying the taxes on these savings limits the total dollar amounts saved to the tax deferred environment,” Crawford said. “If you can maximize your savings opportunities while saving into the Roth environment, it is a win.”

3. Manage debt strategically

Paying down debt is a good thing. Paying down debt at the expense of saving for your retirement is a mistake. If you have high interest revolving debts, these need to be managed immediately. Other loans (real estate, student loans) can be managed to allow you to pay them down over an appropriate amount of time while still allowing you to save for retirement.

We know it’s complicated, and with a full time career, and your life to balance, it can seem overwhelming. If you are interested in learning more about our philosophy for wealth accumulation, the 3to1 Foundation hosts a two-day seminar teaching the concepts of record keeping and organization, goal setting, accumulating wealth, budgeting, debt management and retirement planning to attendees in all stages of life. The next Accumulating Wealth Seminar is scheduled for June 1, 2018, in Plano, Texas. To learn more or enroll, click here.

Peace of mind is available to you. CWA is known throughout the dental industry for our principles of wealth accumulation. Through an initial evaluation and assessments, our team can help identify financial challenges and opportunities, set annual and long-term goals, and work with you to implement your financial plan. CWA is there to provide guidance and direction each step of the way. Reach out, we’d love the opportunity to see how we can help.