By: CWA Planner Angie Svitak and National Dental Placements CFO Christy Ratcliff

The choice to own your own dental practice is, of course, applicable to both men and women; however, even today it is hard to deny the extra sociological pressure that a woman carries in the workforce.

Much of the time, women put pressure on themselves to “do it all,” and the thought of the associated risk of ownership adds to that stress. But, consider the facts when contemplating ownership versus associateship.

Same dentistry, more money.

It’s no secret that ownership leads to more compensation.

Think about it this way, most women in dentistry will work approximately 35 years. Let’s presume you worked at a one-doctor practice that is able to produce approximately $62,000 of doctor production a month. This is, on average with hygiene, a $1 million practice.

As a long-term associate paid 30% of your doctor collections, you may average somewhere around $223,000 annually. On the other hand, if you were an owner of that same practice and presume an overhead of 60%, you could make $400,000.

You would make considerably more money as an owner for the same amount of dentistry.

Does reward outweigh risk?

Imagine what that extra $177,000 per year could do for you and your family over the long term. That income, used strategically, could accelerate the time towards reaching your personal and retirement goals.

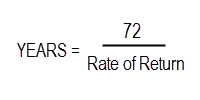

To illustrate this, let’s look at the Rule of 72—a common tool used by financial planners, it is a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest.

It says that if you divide the number 72 by your annual investment rate of return, the result is equivalent to how many years it will take for your investment to double.

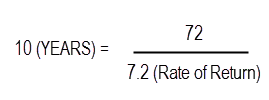

So, back to imagining an extra $177,000 in your pocket per year. Based on the Rule of 72, if we assume your investments are receiving a 7.2% rate of return, your money would double every 10 years.

If you work for 35 years, your money will double three and a half times. Assuming you save all your additional earnings, doubling $177,000 three and a half times results in $2,124,000 of accumulated wealth. Which means, the decision to not be an owner in a practice for one year, is now not just a $177,000 decision, but a cumulative total of $2,124,000 – based on only one year of additional earnings alone.

Building ownership in a practice brings other long term benefits, for example selling down the road will help build your nest egg for retirement. You will also have the ability for more efficient tax planning, as ownership can mean more opportunity for tax write offs.

Beyond the Financial Freedom: The Beauty of Partnership

Truth is, money isn’t everything.

Increasingly, time and flexibility have become more important in our society. Balance is essential, and means something different to every person. Whether it be family, personal or social obligations, more and more women are hesitant to start a new business because they don’t want it to consume them.

Yet, as a strong woman with a drive to be a leader in your community and dentistry, do you have to make that choice? What if you could have both?

Here is where the beauty of a partnership comes in. More frequently we see two colleagues, especially women in dentistry, merging forces to create a single practice which allows them both to be in control of their dentistry and destiny. They share the burden of running the business, which allows them to both reap the financial benefits of ownership.

So how does it work? The beauty is, there are many ways it can work, and many ways to structure it. The goal is to create a partnership that has a structure and ownership that fits what you need.

More often we see women in dentistry buying into a practice in stages, which allows for flexibility in ownership, which you may need depending on the phase of life you’re in.

Look at this scenario—it’s early in your career and you need more time at home for family or personal activities. You could buy into a practice at 33% ownership, then as your children get older or your personal activities at home change, you may choose to buy an additional percentage to get you to 50% ownership. As you near the end of your career, you may wish to slow down again and reduce your ownership to begin transitioning into retirement.

Strength in Numbers

Not only does this type of ownership allow you to manage your individual production, but it allows you to mitigate some of the business risk and responsibility. You can share the administrative functions and expenses, and also have another trusted person to share in your vision of the practice, and to lean on when you need time off or things of that nature.

Based on the CWA 2016 “How Does Your Practice Compare?” Report, a typical one-doctor general practice has a profit margin of 40% of their collections, and a typical two-doctor general practice profits 46% of their collections. This increase in profit is due to the ability to share the fixed expenses. With a partnership, not only do you receive the increased benefits of flexibility, but you can be more profitable. There truly can be strength in numbers.

As you can see, like any self-employed individual, harnessing the entrepreneurial spirit can allow women in dentistry the opportunity to create a practice and ownership solution that works for their life, both professionally and personally. Ownership can be daunting, but it can also be fulfilling and rewarding—you just have to find the path that works for you.

Cain Watters & Associates and National Dental Placements are affiliated firms.