A new set of clubs? Airline tickets for this summer’s vacation? Paying off that digital intraoral x-ray sensor that you bought last summer? How do you plan to spend that tax refund this year? (Wait a minute. You don’t think you will get one?! Don’t worry. We will get to you later.)

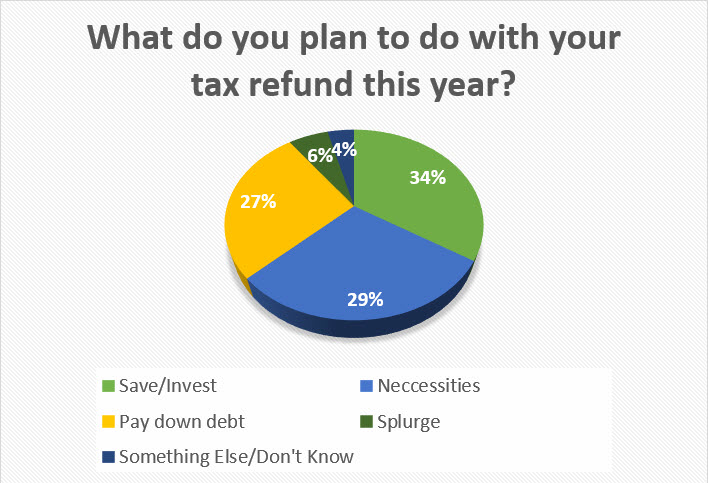

What about your clients? Sure, you hope they will be spending theirs on the down payment for their child’s wisdom teeth or braces—but here is how the average American is spending those refund checks this season:

Source: Bankrate March 2017 Money Pulse Survey Results

With a majority of Americans using their refund to pay down debt or save/invest it, only 6% of Americans admittedly plan to splurge. The other large percentage goes to those who plan to spend it on necessities, which may include dental procedures.

Didn’t get the refund you deserve?

Irked because you don’t expect a refund this year? Don’t chalk it up to your profitable year at the practice – rather, ensure your tax professional is on your side – and knows enough about the intricate world of dental practices to be using it to your advantage. CWA Financial Planner Kellee Harrigan says that there are a few things to keep in mind to get ahead of the curve for next year.

– Know what deductions your practice can benefit from. For example, do you produce your own crowns in house? If so, you should be leveraging IRC section 199 – Domestic Manufacturing Deduction. This is only one example, there are many other items your CPA should help you identify that you could benefit from.

– Plan your equipment purchases. Contemplating a large purchase around the end of the year? Your CPA can evaluate if you should purchase this year or next to benefit from the equipment deduction more.

– Evaluate your lifestyle. Are there business expenses you are taking on personally that are really business costs? Your CPA should have eyes on both your personal and business expenses to ensure all is accounted for in the correct place.

– Pension Plan – Are you taking advantage of your retirement plan? Is it structured in a way so the doctor can maximize employer contributions, and still reduce the overall cost of the plan?

– Tax Planning – Start in the middle of the year, the end of the year is too late. For ex: Is your entity structure set up in the most advantageous way? Are you spending too much on dental supplies or labs? Your planner can identify issues early, and in time to get back on track.

Don’t tackle taxes alone. Talk to a professional early that understands dentistry to prepare for next year’s taxes and ensure yourself a stress free season.

Our financial planners and seasoned tax professionals are always here to help dental professionals navigate complex tax laws and get the most out of your paycheck, take the next step and contact us today.