Important Update to Webinar – Please read before listening

Updated 3:00 p.m. CST on April 9, 2020

Our updates around the Paycheck Protection Program (PPP) loans are consistent with the daily changes issued by the Small Business Administration (SBA) and the U.S. Treasury.

There is one new development since our previous update:

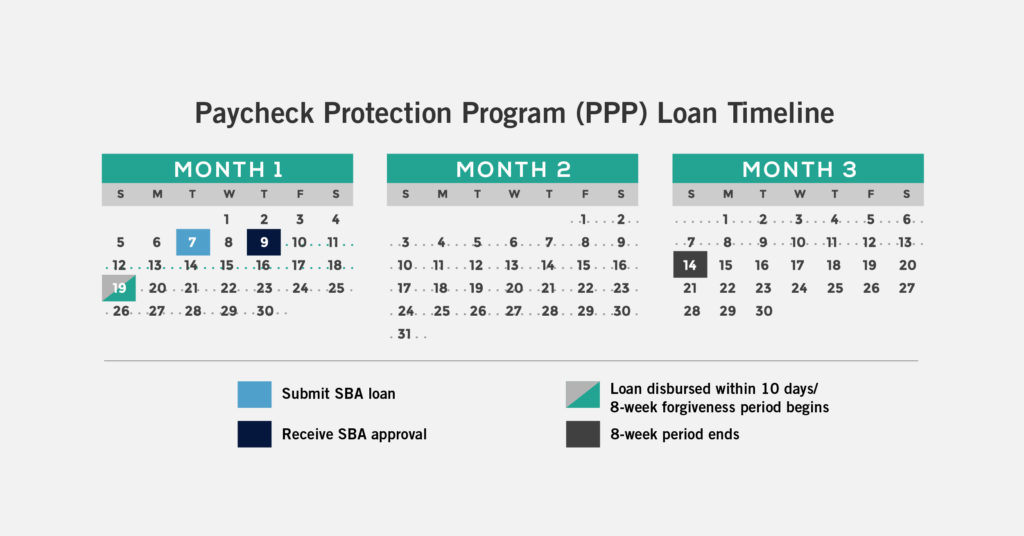

The SBA has increased the mandatory loan funding date, after SBA approval, from 5 days to 10 days. The start date for the 8-week period for spending the loan did not change. It begins on the same day of the first disbursement of the loan, as previously reported.

While this is not what we were hoping for, it does offer some assistance to dentists and small businesses that are on lockdown. It also means that each business is now faced with a decision. If you haven’t yet, please watch the webinar as Partner Dan Wicker presents the options available to small businesses and outlines a decision tree to aid in defining your path.

There is no way for CWA or anyone to know how long the $350 billion funding will last. Although we do believe it will run out, the likelihood of future stimulus is likely. We also believe the longer you can delay the funding, the greater it will be to help rebuild your business and achieve forgiveness. We acknowledge that many want to secure funds for the business for working capital, even if you don’t receive forgiveness. This is a business decision for each of you based on your individual needs.

Please view the sample funding calendar and webinar to help aid in your decision.

Unfortunately, this ruling eliminates the “apply and defer receipts” strategy, which was valuable not only for dental practices, but for thousands of small businesses across the U.S.

Through CWA banking contacts, we are aware that there have been thousands of loans across the country with SBA approvals and E-Tran authorizations based on delayed funding. We understand the banks are pushing back on the SBA, however there is no guarantee that changes will be made.

The content of the webinar, outside of this new SBA guidance, is still sound. The decision tree section of the webinar weighing the option of filing now with the potential for only 30% of the PPP loan forgiven versus waiting and watching how the $349 billion SBA guarantee amount is decreasing, now affects all CWA clients.

Additionally, President Trump and U.S. Treasury Secretary Mnuchin continually say they will ask Congress for more money. The latest comments quantify it as an additional $250 billion.

We will update you as this continues to develop. We will continue to evaluate the situation to make sure clients are utilizing every resource available to help their business during this time. As SBA guidance continues to evolve, we will update our recommendations surrounding PPP if necessary.