Leverage this under-utilized strategy to gauge practice health

As a dental practice owner, a lot of non-clinical factors fall on your plate: human resources, tax filing, contracts, insurance and keeping your accounting books straight. These are all things that are tempting to overlook, but when ignored, can inhibit growth and even cause significant problems in the business.

“The importance of good quality bookkeeping is often the most underutilized tool in dental practices,” CPA Judson Crawford says. “I’ve found that when I teach my clients how to interpret and utilize their books, they are empowered to shift their business into the next level of growth and profitability.”

Bookkeeping is the practice of keeping accurate accounting records. Records that are essential to a company’s sustainability. Accurate bookkeeping helps a business not only manage its cash flow and meet its financial obligations, but plan its investments.

Some business owners treat it as a painstaking necessity that must be done for their CPA to be able to file their taxes. Having good clean books can help you do more than just file your tax return on time. It can help you identify areas of over-spending, map business growth or even spot fraud.

TYPES OF FINANCIAL LEDGERS

Let’s start at the beginning. Financial ledgers display an account of your business’ profit and loss. The revenue coming in is compared against the dollars going out due to expenses.

The two most important ones to look at are your profit and loss statement and your balance sheet.

Balance Sheet:

A balance sheet is a statement of a business’s assets, liabilities, and owner’s equity as of any given date. Typically, a balance sheet is prepared at the end of a set period (e.g., every quarter; annually). A balance sheet is comprised of two columns. The column on the left lists the assets of the company. The column on the right lists the liabilities and the owner’s equity.

The balance sheet is an important clue to a business owner about how his or her company is doing. However, the owner isn’t the only one who would look at the balance sheet. Lenders review it when applying for financing, or even potential investors, partners or buyers, should you be looking to sell a portion or all of the practice.

Profit and Loss Statement:

A profit and loss statement (P&L), sometimes referred to as an income statement, is a financial statement that shows the businesses’ revenues and expenses during a particular period. It indicates how the revenues are transformed into net income.

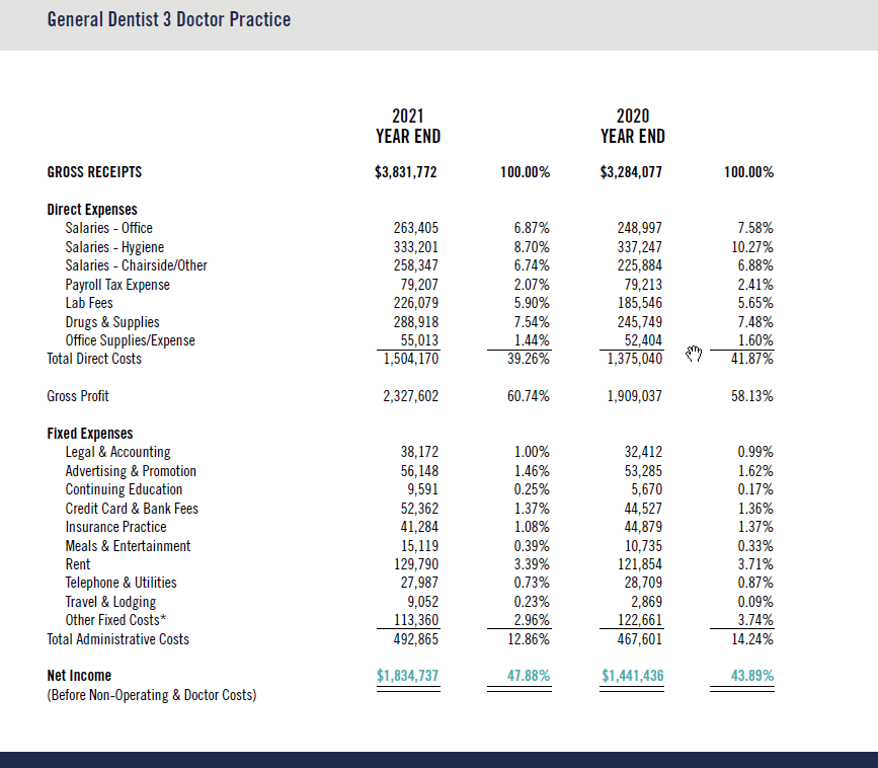

Take a look at this profit and loss statement from the newest How Does Your Dental Practice Compare? Report, shown for a three-doctor general dentistry practice:

In addition to recording the practice’s collections, the P&L breaks up your statement into two separate categories:

- Direct expenses: Costs that vary based on production. For example, as you see more patients, these are costs that will increase – like lab fees, supplies, hygiene and chairside salaries.

- Fixed expenses: These are costs that are fixed to your business and are constant regardless of the quantity of goods or services produced. For example, costs such as your building rent, insurance, pension or subscriptions are standard month to month, regardless of your production.

Monitoring both direct and fixed expenses allows the business to track the key categories and monitor for either overspending or areas of growth.

ORGANIZATION IS IMPORTANT

Regardless of if you manage this report yourself or hire a bookkeeper to do it, the P&L will not be helpful if it’s not organized in a way that is digestible. It shouldn’t be five pages long in detail, with every single expense in a different category. Similar to tracking your personal expenses, categorizing helps you focus on the big picture. Remember, if it’s not usable—you won’t use it.

Annually, an organized P&L allows you to sit down and review where your business is this year to date, where it was last year and even the year before. This allows you to spot trends and outliers.

A quick monthly review is also just as important. You may have big things that come through that you wouldn’t remember at the end of the year. For example, if your insurance fees were really high last month, you will remember that you paid your annual insurance premiums. With all you have going on, it’s unlikely you would remember each detail like this at the end of the year.

It’s also important to keep in mind that your CPA cannot proactively plan your tax projections if you do not have updated books. They also cannot strategize on your behalf if you are only preparing them on a six- or nine-month window.

OUTSOURCING

Handing the management of your financial statements over to a professional not only brings reporting consistency into the categories, but also helps ensure bank and payroll reconciliations are done monthly, allowing the owner assurance that they are always tied out to cash. Staying organized can also help spot fraud.

Among the other benefits, having good, clean books means it will take less time for your tax preparer to file your tax return. That can save you both time and money on your tax bill. It makes it cheaper, but it also prevents errors from being done. When stuff gets missed, you pay more in taxes.

Allowing a professional accountant to manage the monthly bookkeeping for your business doesn’t only save you time—it allows you to be strategic.

Rather than spending your limited time categorizing expenses, owners can now be empowered to use the output strategically to improve their business. Perhaps accounts receivable has been running too high and has gone unnoticed, or lab supplies have gradually crept up over the past six months. Insight into changes early can help increase profitability in the short and long term.

Having a quick and easy way to view the front line of your practice’s finances is essential to its long-term success and you meeting your long-term personal goals. Learn more about CWA’s accounting services for dentists.