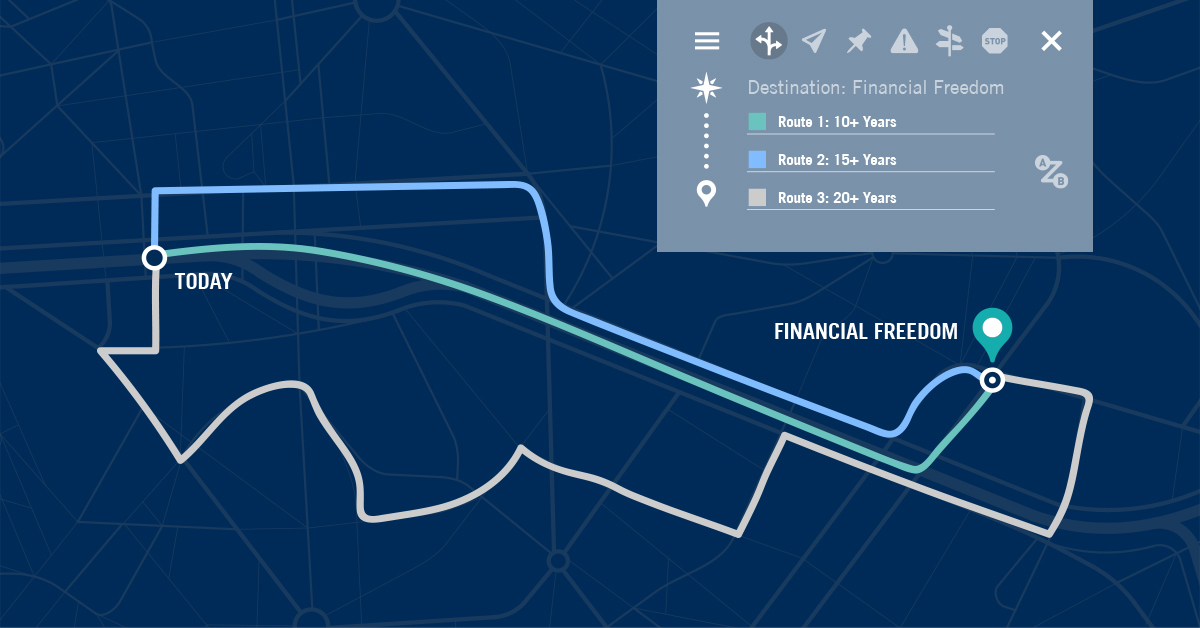

The investment milestone map of the 3-to-1 money growth concept is the foundational depiction of wealth accumulation for CWA clients.

The philosophy came to Darrell Cain one day in an unlikely place. On his drive home from Thanksgiving weekend in 1985, in the dark of night with his family sleeping in the backseat, he sat listening to a cassette tape a friend gave him about investment principles. The narrator touched on an illustration of compounding interest, and Darrell began putting the pieces together of how to communicate this age-old concept to his own clients.

“In my mind, I’m driving along, and all of the sudden I could explain the hyperbolic curve [and its] break points,” he said. “You don’t need an illustration on how compound interest works, what you need is an illustration that tells you what to do based on where you are in the spectrum.”

Audio: Hear the full story from Darrell of this pivotal moment in our recorded interview.

CWA has embraced this concept ever since.

THE CONCEPT

Darrell summarized 3-to-1 wealth accumulation in his own words:

“Three to one is the visualization of the process of accumulating wealth through compounding interest,” he said.

The fact is, based on the concept of compounding interest, “3-to-1” is actually a milestone within the wealth accumulation process; it’s where an investor is making three dollars to every one dollar invested. Before hitting 3-to-1 money growth, there’s also the milestone of earning 1-to-1 and 2-to-1, and after an investor could hit 4-to-1, 5-to-1, and so on.

The concept is based on the premise that a principal sum of savings gains interest over time. By reinvesting that interest, it adds to the principle, in such that the interest accumulated in the next period is added to the principal sum thus increasing the previously accumulated amounts.

Let’s look at a simple example. If you have $100 and invest that in a savings plan that earns 8% interest, and let it sit for five years without adding any additional money, at the end of year five you would have accumulated $146.93 as a result of the original $100 (see table). Continue that process at the same rate, and at the end of year 10 you would have accumulated $215.88 as a result of the 8% return on the initial $100 investment. That’s the first milestone: earning one dollar to every dollar invested.

| Year | Beginning Balance | Interest Earned | Ending Balance |

| Year 1 | $100 | $8 | $108 |

| Year 2 | $108 | $8.64 | $116.64 |

| Year 3 | $116.64 | $9.33 | $125.97 |

| Year 4 | $125.97 | $10.08 | $136.05 |

| Year 5 | $136.05 | $10.88 | $146.93 |

As you can imagine, hitting that milestone is much more exciting when an investor starts with a larger sum and continues to add money to it throughout the 10 years and beyond.

Another example illustrated in our 3:1 growth chart: an investor saves $60,000 a year in a savings plan that has a consistent 8% return. At year 10, when the investor hits 1-to-1, he or she would have accumulated over $850,000 and their money would be growing at a rate of 1-to-1. See the math.

Hitting the Goal of 3-to-1

With all the potential milestones, Darrell finds hitting the 3-to-1 point the most important in an investors journey.

“If you look at the math, the investment before hitting the 3-to-1 milestone is what matters the most,” he said. “Because only about 5% of the outcome of the money you’re going to have accumulated after hitting 3-to-1 comes from what you additionally save. The money saved [after that point] has a very small impact.”

Usually after a person hits their personal 3-to-1 goal, that’s when they buy something they have dreamed of, like a lake house or other luxury, he said. After Darrell hit his personal 3-to-1 milestone, he bought a Jaguar convertible—detailed with a vanity plate that read “3:1.”

“What it represented is [my] 3-to-1,” Darrell said. “I now took the extra money I was saving per month and bought the car.”

Though, hitting 3-to-1 is more than the metaphorical finish line. Here’s his three reasons to set your sights on this benchmark:

1. Investors can create a definitive goal: By using 3-to-1 as a rule of thumb, it allows people to define how long they have to save in order to reach their retirement goals. Even though the amount for retirement may vary by individual, hitting 3-to-1 is attainable if the investor has the time and a consistent return.

2. Clear-cut decision making: By setting a goal and developing a financial plan, this allows investors to make educated choices on purchases moving forward.

“Gives you another option to know your choices vs. consequences,” Darrell said.

Listen to his story about buying his first video recorder here.

3. Measurement for your financial team: By setting a north star for your financial future, this allows investors and their team to determine progress towards that goal and strategically change paths if necessary, because life is ever changing.

Listen to Darrell Cain explain this concept in his own words.

Want to learn more about saving and other investing concepts? CWA’s 3to1 Foundation is a nonprofit organization that teaches these money saving principles and financial strategies; consider signing up for its next Accumulating Wealth Seminar.

If you are ready to map your personal 3-to-1 growth chart and start accumulating wealth toward your long-term goals, connect with one of our financial team members.