CWA INVESTMENT NEWS

October 5, 2015

by Brad Sanders

The State of the Market

The S&P 500 finished up the third quarter of the year -5.29% in 2015. Stocks have been sold over the past few months because of the ongoing issues, we’ve been covering in CWA investment news recently. The potential for China to cause a global recession, the looming Fed rate decision, and market overvaluation have caused a spike in volatility and worry among investors.

It seems all my recent commentaries are always on the breadth in the market because the fact is, we’re not seeing improvement. Out of the 500 stocks in the S&P 500 Index, only 186 have a positive return YTD. Roughly two-thirds of the index is underwater.

Lipstick on a pig?

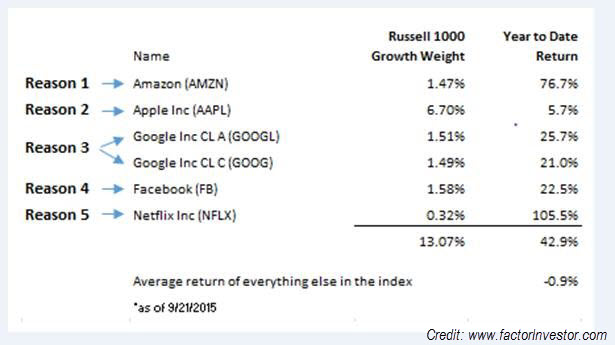

Many of the high-flying growth stocks for the year are making up a disproportionate amount of positive return in the market. If it looks attractive to you, consider Factor Investor’s recent analysis of the Russell 1000 Growth Index:

All of these stocks are a large part of the S&P 500 as well and are skewing the negative YTD return even higher than it would be otherwise.

A word of caution: Do not chase yield.

One of the first lessons in investing is not to chase yield. Many investors get themselves in trouble when in their thirst for high income, they buy stocks or bonds that sport high yields. What they forget is to consider all the reasons why those yields might be so high. The risk may have been extremely high, or the dividend may be in trouble of being lowered, thus turning the investment into a money loser – and usually in very short order.

One area of the market that has been a popular source of yield over the past five years has been the MLP space (Master Limited Partnerships). These companies are largely midstream companies that service the oil and gas industry. In September alone these partnerships, as measured by the Alerian MLP Index, were down -15.28%. Year-to-date they are down -30.67%. Many of these partnerships had yields at the beginning of the year in the 3% to 5% range, and now many of those same yields are 10%+.

These yields are tempting, but if you think about the slide in oil prices, it’s very possible that producers will now want to restructure pricing with these companies and thus put the yields at risk. Additionally many of these companies operate with leverage, making a drop in revenue dangerous not only to the yield, but to the company itself.

The bottom-line is, if you find yourself being drawn to high-yielding stocks or bonds, particularly in a volatile market, you need to be asking a lot of questions starting with, “What are the true risks here?” One thing savvy investors know is that things aren’t always what they seem.