Changes to Compensation for Overtime Hours May Have Limited Impact on Practice Owners

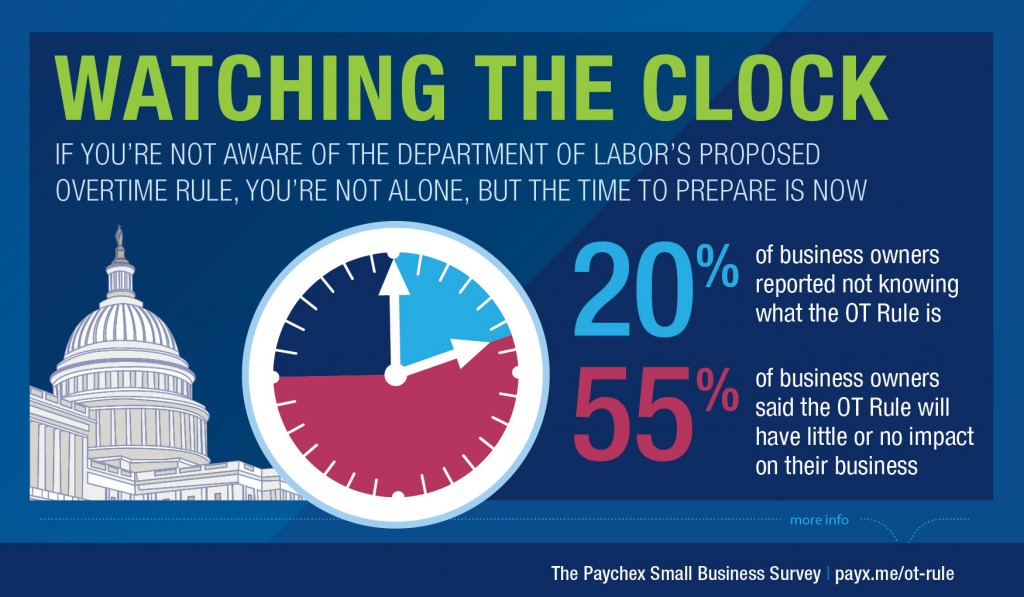

The sweeping legislation increasing the salary threshold for nonexempt employees from the Department of Labor will affect many business owners, but the impact on dental practices may be limited. The Final Rule takes effect December 1, 2016, and requires any white collar worker earning less than $47,476 a year, or $913 a week, to be paid overtime. This is an increase from the previous standard, allowing workers earning more than $455 per week to be exempt from overtime pay.

Because dental practices often pay by the hour, only a few roles such as an office manager position may be effected by the change.

And CWA Partner Toni Lee says, “The good news is many of our clients won’t be affected because office hours are often less than 40 hours a week.”

But for the offices that operate more than 40 hours a week, or have employees on a fixed salary, be aware of these three primary changes:

1. There is no exemption for small businesses like dental practices. Dentists will have to pay any salaried workers earning less than $47,476 per year for overtime.

2. Employers can count bonuses and commissions toward as much as 10 percent of the salary threshold. This is the first time that the Department of Labor has taken bonuses and commissions into consideration.

3. The compensation requirement for the highly compensated employee exemption is now $134,004. This is an increase from the previous threshold of $100,000.

The next FLSA update is scheduled for January 1, 2020. Future updates are automatic every three years. If you believe these changes may impact your business, contact your payroll service provider, employment and labor attorney or financial advisor to learn more.