Proactive planning is key to smoothing out the peaks and valleys

Key Takeaways

- Identify and understand your production patterns.

- Know your break even number.

- Place extra cash into a separate account to pull from in slower months.

Dental practice owners know all too well the cyclical ups and downs of their business. Whether it’s the summer rush, the fall lull, or the race to spend FSA monies, every practice will experience ebbs and flows. It’s how you manage them that counts.

The key is being proactive with planning for the ups and downs, says Bill Harrigan, CPA and Planning Director at CWA.

“Many practice owners don’t take the lows into account until they’re already upon them,” says Bill. “If the business already spent the extra cash flow earned during the highs, it adds a lot of stress during an already stressful time.”

The good news is, with a little proactive planning, practice owners can smooth out the highs and lows — both financially and emotionally.

Step 1: Identify Your Patterns

For many dentists, this might seem obvious. Of course, the summer is busy for pediatrics and the back-to-school rush is crazy for general dentists.

Taking a closer look at two- or three-years’ worth of monthly revenue, however, can reveal unexpected patterns over and above the seasonal spikes.

“I had a three-doctor practice whose fall slow period was more severe than most,” says Bill. “We dove into their numbers, but it wasn’t until one partner mentioned that the other two were ‘always off filling the deer feeders’ that we realized the issue was the docs leaving early on Fridays during hunting season.”

Another factor that can play into revenue dips is the doctor(s) taking an extended vacation. For example, a doctor taking a two-week vacation in April prior to the summer rush will affect cash flow in May, which can be a slow period for many practices. Proactive planning for the temporary slowdown will ensure that the vacation, and the return to work, is a lot less stressful from a financial perspective.

To gauge where your practice ranks on revenue, benchmarking reports using national averages are a great way to get an idea of how you compare. But having a CPA or planner do a deep dive into your financials is often the best way to really understand your production patterns.

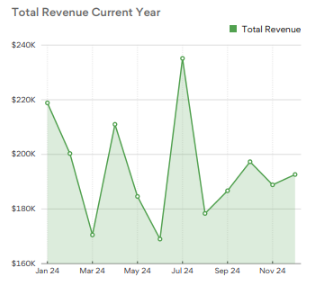

This sample KPI performance report for an orthodontic practice illustrates the differences in revenue by month.

Step 2: Find Your Break Even

Now that the cycles, both seasonal and self-imposed, are identified, it’s time to make a plan to level out the hills and valleys. Bill recommends planning at least six months in advance to ensure your financials are prepared. First rule of thumb, know your break even number.

“The break even point is the level of revenue at which total income equals total expenses, meaning a practice is not losing or making money,” says Bill. “Everything earned beyond that point contributes to profit.”

A CPA can help accurately identify your break even, but in general the formula is:

Break Even = Monthly Costs ÷ Profit Margin %

Once the break even is identified, you have a benchmark to evaluate how to manage cash flow during your slow and busy months.

Referring back to the ortho revenue chart above, let’s assume the practice’s break even is $185,000. For the months of March, June, and August, the business will need to draw from the operating fund.

“For a practice that’s not prepared for it, pulling money from company reserves can be a scary proposition,” says Bill. “That’s why controlling spending during busy periods and keeping extra money in reserves is so important.”

Step 3: Manage Your Extra Revenue

For many small business owners, extra cash in their operating account is cash that will soon be spent on the business. It might be a new coffee machine in the lobby, a larger owner distribution, or technology upgrades. While these might be worthwhile expenditures, earmarking a portion of the surplus each month to savings is equally important.

Bill recommends moving the cash out of the operating fund and into a business savings account.

“Placing reserves into a separate account is important, as it keeps owners from easily tapping into the funds,” says Bill. “During the slow months, moving a portion of the money back into operating capital allows owners to easily track how well the company weathered the slow period.”

For Bill, it’s all about taking the stress out of the equation from one month to another.

“I’m a firm believer that the less stressed my clients are about money, the more money they will make,” says Bill. “After I set my clients up with a plan, it really doesn’t require a whole lot of time, effort, or energy from them to be proactive about this.”

In the end, well-managed cash flow allows doctors to do what they do best: care for patients, grow their practice, and sleep well knowing that the business is on solid ground.

For more ways to increase revenue and profitability in your practice, check out part one and part two of our recent blogs.

If you have more questions about managing the ebbs and flows of your business, or any other professional or personal finance topic, CWA advisors are always happy to help. Set up your free consultation today.