Part 2: Increasing Collections and Lowering Overhead to Maximize Dental Clinic Profit

Key Takeaways

- Benchmark your practice against peers to set clear goals and success metrics.

- Boost collections through clear communication, efficient systems, and patient satisfaction.

- Reduce overhead with budgeting and proactive cost control.

Welcome to the second installment of our two-part series breaking down the Profitability Formula. In this installment, CWA Partner and CPA Judson Crawford breaks down how dental practices can increase collections and lower overhead, which, when combined with the tips to increase production outlined in part one, can lead to more profits for your practice.

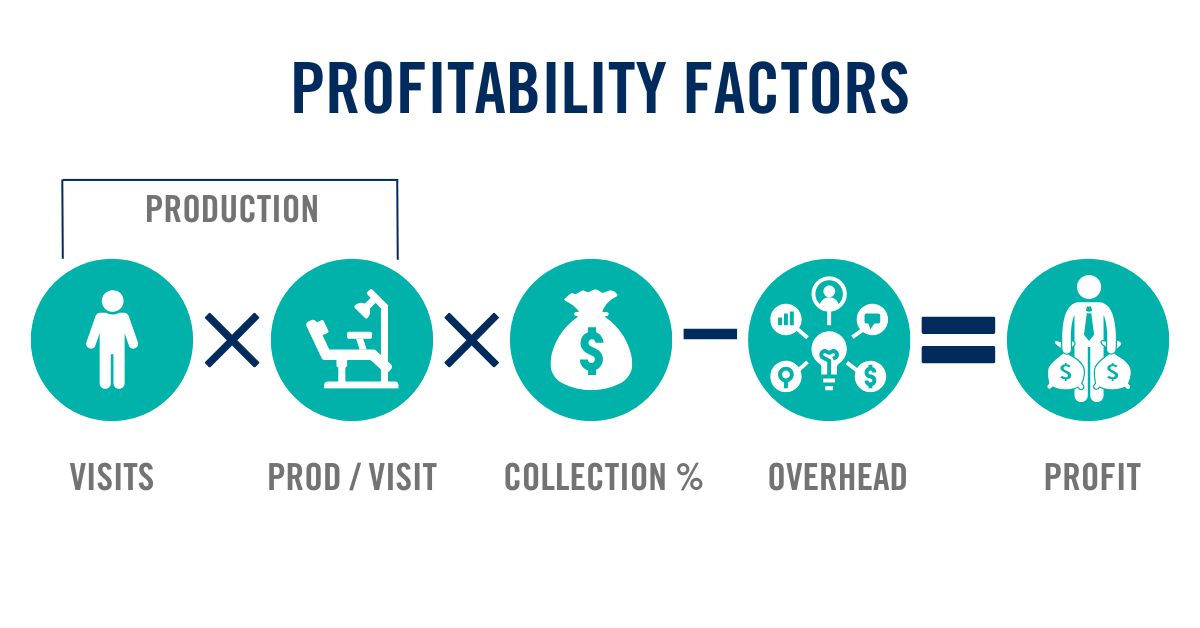

As a quick refresher, here is the Profitability Formula and the key metrics that lead to dental practice profitability.

According to Judson, the first step in increasing collections and lowering overhead is understanding where your practice stands in relation to other practices of the same specialty and size. The How Does Your Dental Practice Compare? Report provides nationwide averages for collections, plus a detailed breakdown of direct and fixed costs that add up to overhead.

“Starting this process with clear benchmarks helps doctors define success metrics and set attainable goals,” says Judson. “Without that competitive context, it’s hard to know what true success looks like.”

INCREASING COLLECTIONS

Boosting collections isn’t just about asking for payment — it’s about creating clear communication, efficient systems, and a positive patient experience.

Step one is to implement a strong financial policy. A well-defined policy sets expectations, prevents misunderstandings, and ensures consistency in handling payments. Ensure that all patients understand and sign the policy, which, at minimum, should cover payment due dates, accepted forms of payment, missed appointment fees, and financing or payment plan options.

Step two is to ensure that the front office understands the critical role they play in the process. Invest in training, so staff is comfortable discussing financial responsibilities with patients and collecting payments at the time of service. Role-playing scripts for common scenarios can help build confidence and ensure consistency.

“It really takes a well-trained, cohesive front office to stay on top of accounts receivable,” says Judson. “Doctors shouldn’t hesitate to look into some outside consulting in that area, as it typically pays off in a higher collections percentage over time.”

The collections percentage is one of the most telling indicators of a dental practice’s financial health, yet many practices fail to regularly track this key metric.

Collections percentage measures how much production is collected. For example, if your net production is $100,000 and you collect $90,000, your collections percentage is 90%. Most successful practices aim for a collections percentage of 98% or higher, according to Judson.

“A high collections percentage means you’re effectively collecting what you’ve earned. A low percentage suggests revenue is slipping through the cracks, whether due to billing errors, lack of follow-up, or uncollected patient balances.”

Strategies to increase collections and lower accounts receivable include:

- Track and monitor your collections percentage, A/R ratio, and A/R days metrics monthly to identify downward trends earlier.

- Collect patient balances at the time of service, equipping your front desk with tools to calculate patient portions accurately.

- Submit clean insurance claims within 24 hours of the visit.

- Prioritize billing and coding education to reduce denials.

- Review your insurance aging report once a week, following up on the oldest claims first.

- Implement effective automated follow-up systems that include text and email, plus personal calls for high balances.

- Add a payment portal to your website to make it easier for patients to pay unpaid balances.

LOWERING OVERHEAD

High overhead can eat away at profits and limit the ability to reinvest in growth or technology. How do you know which costs to optimize first? The How Does Your Dental Practice Compare? Report provides a detailed breakdown of average expenses for practices nationwide. Judson suggests comparing your expenses to the averages and starting with the costs that are most out of line.

It’s not about trying to attack every expense all at once,” says Judson. “Choose two or three that are above the averages and start there.”

He also emphasizes that when it comes to expenses, small changes can go a long way.

“Let’s say you use a partner like Elite Dental Alliance to save 2% each year on your supply costs. On a million-dollar practice, that’s $20,000. If you put that $20,000 a year into a retirement plan for the next 20 years, you’ve just added $1 million to your portfolio.”

Here are a few practical strategies Judson recommends to lower overhead without compromising the quality of care.

Establish a Budget – This may sound elementary, but many practices don’t take the time to define budget parameters for expenses. Using supply costs as an example again, Judson recommends telling staff to cap next month’s order at 5% of the previous month’s collections.

“If they go over that number, they need to get the doctor to sign off on the overage,” says Judson. “This not only gets the employee thinking about costs for the first time, but over time, they’ll stop coming to the doctor for sign-off.”

Bottom line, in any area where a staff member is making a purchasing decision, whether it be marketing, office supplies or any other expense, Judson recommends empowering them to manage those costs within the budget.

Control Costs – Once budgets are established, another tactic many practices use to streamline operations and cut costs is to leverage the power of group buying through a partner such as the aforementioned Elite Dental Alliance.

“Partnering with a company like Elite Dental not only saves a practice money, it saves doctors time because they actively evaluate practices to help identify areas to cut costs.”

Reduce New Patient Acquisition Costs – The cost to acquire a new patient can be up to 25 times the cost of retaining one, so focusing on your current patient roster should be the first priority. Check out part one of this series for more on patient acquisition.

As the Profitability Formula shows, to increase practice profitability, you can’t exclusively focus on one aspect of the business. It takes gradual improvements in all areas to really move the needle. To break it down even further, check out this episode of the Accumulating Wealth podcast hosted by Judson and fellow CWA Partner Hunter Satterfield.

For more insights into improving profitability in your practice or any other professional or personal finance topic, CWA is here to help. Set up your free consultation with an advisor today.