The potential impact to investors

The U.S. Treasury yield curve inverted for the first time since 2006 causing even more market volatility and some economists to warn of a coming recession. But what does this really mean, and how should investors react?

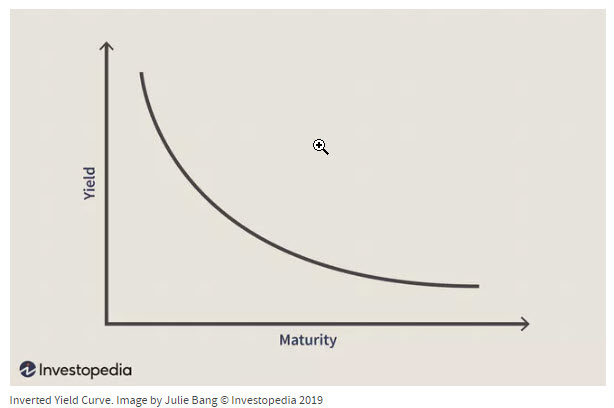

Managing Director of Tectonic Advisors Brad Sanders explains, “in the investment market, there are curves used to measure all types of things. The yield curve is a visual depiction of what’s happening in the market. In short, it’s a real-time depiction of risk appetite.”

The yield curve is composed of the yield on U.S. Treasury securities. In a healthy economy, a long-term investment is typically riskier than a short-term one.

For example, the interest rate for a three-month loan should be less than the interest rate for a two-year loan, which should be less than a 10-year loan. When the yield curve inverts, the two-year rate can be more than a 30-year rate and implies risk takers are very concerned with the trajectory of the economy.

CAUSE FOR CONCERN?

Sometimes a yield-curve inversion and recession are the necessary price to bring down high inflation, as happened in the early 1980s when the Fed used high interest rates to tame double-digit inflation.

At other times, the Fed perhaps goes too far. In 2006, the central bank pushed its benchmark short-term rate above 5% while long-term interest rates remained anchored below that level. The low long-term rate might have been a sign that the market expected subdued inflation, and rate increases weren’t needed. A financial crisis and recession followed in 2007 and 2008.

Historically, the inverted curve has been an accurate recession indicator because it’s been a pure representation of market forces. However, today, things are a bit different.

The Fed has been artificially depressing rates, post financial crisis, to keep them near zero for the better part of a decade. When you cut short-term rates to zero, it distorts prices of all assets and forces capital back in the market.

Today, we have the pandemic impacting the global economy with supply chain issues and a sudden spike in inflation. In a move to cool inflation pressures, the Fed raised rates. And while it’s only a small amount, it significantly increases the debt service costs for the United States, resulting in a shake up of the bond market.

THE BOND MARKET

Investors understand that the stock market involves risk, however, investors view the bond market differently. Since the mid 1980s, there has been a 30-year bull market for bonds as rates moved from the high teens to zero, which has caused investors to view bonds as “safe money.”

Now we are in a period where the bond market is down 8%, causing panic from investors over potential losses. This negative sentiment is further depressing prices and causing more losses.

WHAT NOT TO DO

“In this environment,” Brad says, “don’t’ panic and go out and sell all your bonds.”

Step away from staring at your account statement and the losses in your bond portfolio. Don’t try to fix it. The bond market is contra to the stock market, moves differently than equities and is still a diversifier.

Remember, there has been a change in the economy, with a deflationary environment quickly shifting to an inflationary environment. It’s understandable that people are feeling uncertain. But Brad reminds that you should not react to the bond market the way you would react to the stock market.

“A lot can happen still if you exercise a little patience,” Brad says. “Let this cycle play out. There is no environment where we have recession and rates go up. You can’t fix it. The fix is to keep the viewpoint that this is contra to the stock market. We’ve seen this before and it can get better quickly. Ignore the fear mongering.”

Today is not the time to abandon the bond portion of your portfolio. The bond market is experiencing severe illiquidity right now because there are more sellers than buyers, which is causing distressed prices.

They shouldn’t be distressed permanently and will revert in due time. Should the country move into a recession, the stock market will go down, but bonds should go back up. All you need to do is wait and not react.

The market can be skewed by emotion and behavior. Your investment advisor should be your source of sanity and an anchor through these times, offering sense to the insensibility of the media and the noise it brings.

Keeping focus on your long-term strategy and goals, designed to weather volatility such as this, can help bring peace of mind. If you’ve yet to set a strategy you feel secure in, contact a member of our team.