Paychex Payroll Solutions releases staff salary averages for general dentists

CPA Angie Svitak frequently gets questions from her clients around how much they should be paying employees in the practice. So when Paychex Payroll Solutions released their latest payroll benchmark by region, she was excited to be able to share it with her team.

“It’s helpful for practice owners to have access to salary data that is specific by geographic region,” Angie says. “When you only look at national averages, though helpful, you don’t get the full picture.”

Some regions will fall well below, or well above the national average. It could be related to living in an area with a high cost of living, or unique cases where one must pay premium if there is, for example, a hygiene shortage in your area.

Being armed with relevant information can help open up compensation discussions with your staff. For example, if an office manager is asking for a significant increase, being able to access statistics from dental practices in your area or comparable areas can either combat or justify their request.

Avoiding a surprise “compensation talk” by an office manager or hygienist is easy to do. Owners should initiate consistent, annual compensation reviews with their staff. This is also a good opportunity to remind staff that benefits are not just hourly wages. An employee’s full compensation plan includes healthcare, 401(k), uniform allowances and other benefits unique to that practice.

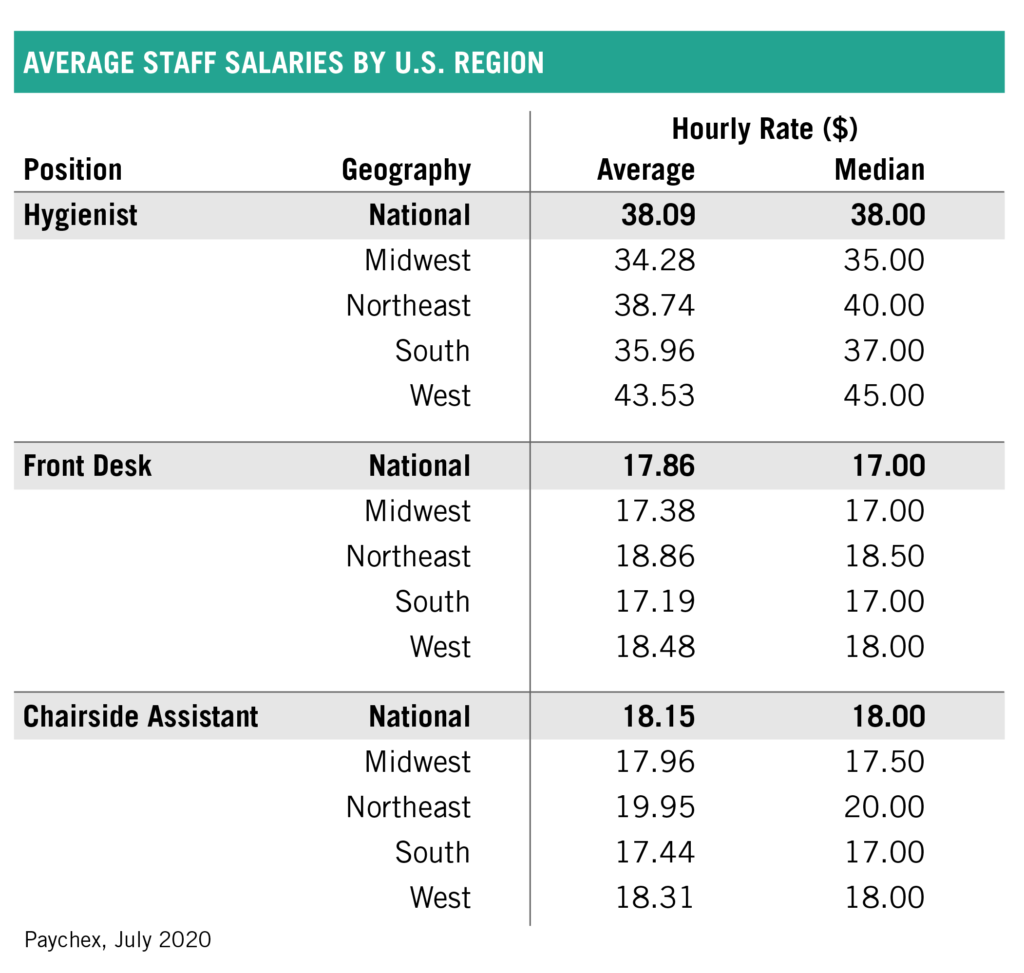

Paychex just released salary benchmarks (available below) on practice payroll salaries by position and geography to equip practice owners with information they need for these conversations. With a specific department focused solely on dental practices, Senior Sales Consultant Amy Hammond says this report answers many frequently asked questions.

“We have helped keep dentists in compliance with the IRS, time systems, worker’s comp and more,” Amy said. “Our goal has been to take the burden of payroll of dental practice owners for over 20 years.”

LOOKING AT THE BIG PICTURE

“Looking at your staff salaries by hourly pay rates alone will not give you the insight you need to gauge if they are too high or low.” Angie said. “In order to get an accurate check on this metric you will need to know your staff salaries as a percentage of your collections.”

It’s helpful to have a pulse on what’s normal for both existing and start-up practices. General practices should target keeping staff salaries between 20-24% of collections (excluding doctors). Because the range can vary slightly by specialty, especially those without hygiene, it’s a good idea to check out our latest How Does Your Dental Practice Compare? Report by practice size and specialty for a more specific target.

As the largest expense on your balance sheet, it’s more important than ever to keep staff salaries consistent. Allowing staff salaries to get out of line will quickly impact your bottom line.

Concerned that you’re the cost of staff salaries in your practice is on the rise? Our advisors remind that consistency is key. Although it can be difficult to get it back under control, there are strategies for getting your averages back into range.

How are CWA practices keeping overhead down and income up? Schedule a complimentary consultation with a member of our team and identify areas for growth in your practice.