Why it’s more important than ever to understand it.

KEY TAKEAWAYS

- In 20 years, an estimated $84 trillion in financial assets will move from baby boomers to younger generations, and women are poised to become the most influential investors.

- Combining male and female perspectives can lead to a more balanced, resilient, and purposeful investment strategy.

- The right asset allocations, diversification, and tenacity can help investors achieve their unique and personal financial goals.

While everyone is unique, many studies over the last few decades have uncovered consistent patterns in how men and women approach investing differently.

When it comes to investing, gender can influence more than just the size of a portfolio — it can shape how decisions are made, what risk is viewed, and what long-term goals are prioritized.

While both genders typically share the same end goal, many studies show that men tend to be more risk-tolerant, and women lean toward a conservative approach. This tendency is echoed by the findings of Brittany Frazier, CPA, who leads the Women in Financial Planning group at CWA.

“As a financial planner, I see these differences play out across the table from me every day,” says Brittany. “I think it’s important that we as planners catch up to this gap because change is coming quickly.”

What change, you ask?

Over the next two decades, the world will witness one of the largest shifts in financial power in modern history — an event dubbed The Great Wealth Transfer. As an estimated $84 trillion in financial assets moves from baby boomers to younger generations, a significant and transformative trend is emerging: women are poised to become the most influential investors of our time.

Today, women already control an estimated one-third of total U.S. household financial assets, and this is only accelerating. In 20 years, some projections suggest women could control 70% of U.S. wealth.

Brittany says this marks a fundamental shift in how wealth will be managed, invested, and directed.

“Historically underrepresented in financial decision-making roles, women are now stepping into the spotlight — not just as beneficiaries, but as active and empowered investors.”

HOW GENDER AFFECTS INVESTMENT DECISIONS

Understanding how men and women invest isn’t about generalizing or stereotyping — it’s about recognizing that biological, societal, and behavioral differences influence decision making which can help both genders come together to make more informed financial decisions.

Men are generally more comfortable with risk, tending to trade more frequently, and are more likely to pursue high-growth (and often higher-volatility) assets like crypto or private equity opportunities.

Women are more risk-aware, taking a cautious and thoughtful approach to investing. They typically prefer steady growth over aggressive, short-term gains. More likely to “buy and hold,” women tend to trade less frequently.

So which approach provided the highest returns over time? Studies show that women investors outperformed men by between 0.4 and 1%. Brittany feels this slight advantage comes down to women’s propensity to take a goals-based approach and men taking a results-oriented approach.

“Women are intrinsically planners, while men are doers,” says Brittany. “While both approaches have their upsides and downsides, combining both perspectives can lead to more balanced, resilient investment strategies.”

MARRYING THE TWO INVESTMENT STYLES

Brittany and her team refer to this combined approach as purpose-based investing.

“Purposeful investing involves making decisions based on your time horizon and risk tolerance, which in turn drive your allocation and diversification.”

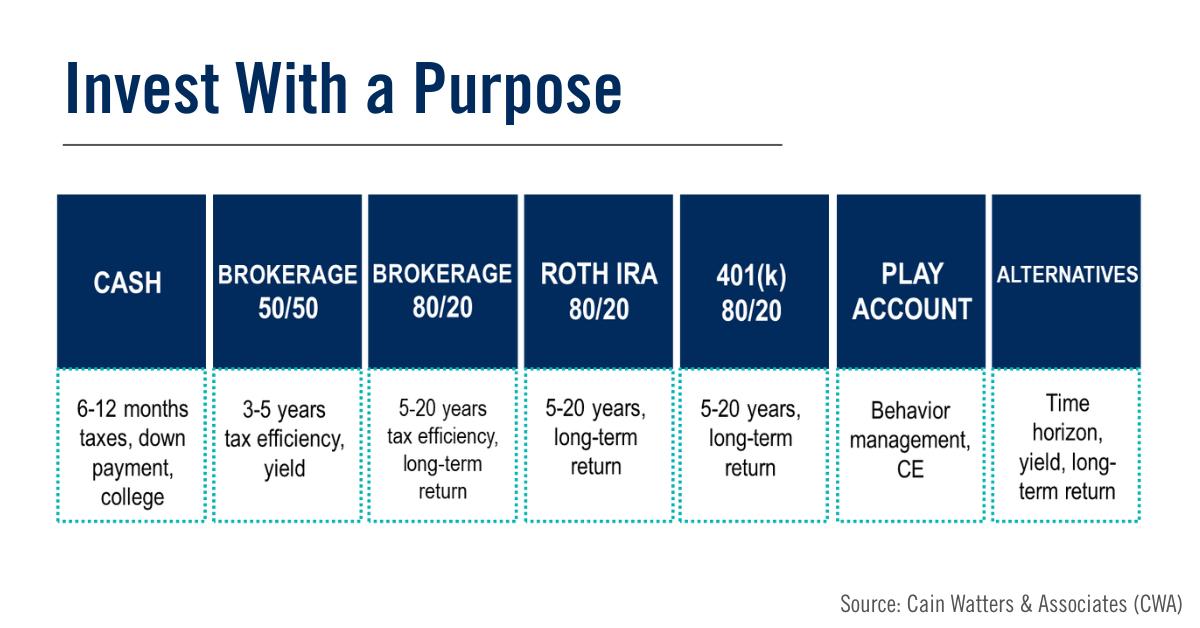

The chart below shows an example of how investing with purpose can create a balanced portfolio designed to achieve short, middle, and long-term financial goals.

From creating a bucket of liquid cash for near-term expenditures to placing money in the right middle- and long-term investment vehicles, a purpose-driven portfolio can take the emotion out of investing — which can help any investor.

“Emotion is a big factor that can negatively affect portfolio performance,” says Brittany. “Buying and selling in an effort to time the market can be costly, because you have to be right twice.”

For example, if an investor put $10,000 into the S&P 500 and left it fully invested in the S&P for a 40-year period (Jan. 1, 1980, to March 31, 2021), that $10,000 would have grown to $1.09 million.

However…

- If the investor missed the five best days in the market during that period, they would have had $676,395.

- If they missed the 10 best days, it would have been $487,185.

- Missing the 30 best days would have resulted in $176,519.

- And missing the 50 best days? That $10,000 would have grown to only $77,920.

“Time in the market is so important, and too often, emotions get in the way,” says Brittany. “With a purpose-driven approach and a little patience, your portfolio is assured not to miss the best days in the market.”

While both the chart and the market timing breakout are general examples, Brittany says they both illustrate the importance of leaning on a professional to provide the right asset allocations, diversification, and tenacity to achieve each investor’s unique and personal financial goals.

“Proper financial planning requires diving into some personal areas to put together a plan that works for the long term,” says Brittany. “If your advisor isn’t asking some thoughtful and personal questions, that may be a red flag telling you to find someone who will.”

She also says the real opportunity lies in understanding and embracing the different investment styles.

“For both men and women, that means being aware of your own tendencies and biases to build a healthier portfolio,” says Brittany. “For the financial industry, it means designing services and strategies that reflect the full spectrum of investor needs. At CWA, we continue to approach investing in this way to have our clients feel financial peace and security while also meeting their goals.”

For more insight into Brittany’s research and her Women in Financial Planning group at CWA, check out her guest appearance on the popular Accumulating Wealth podcast.

For advice on optimizing your personal or professional finances, or any other financial question, the CWA team is always here to help. Set up your free consultation today.