March 17 update on T Bank & UMA Model Performance from affiliate Tectonic Advisors

Given the veracity of the market decline yesterday, we felt it pertinent to provide you with a quick snapshot of how the CWA T Bank and UMA models are doing.

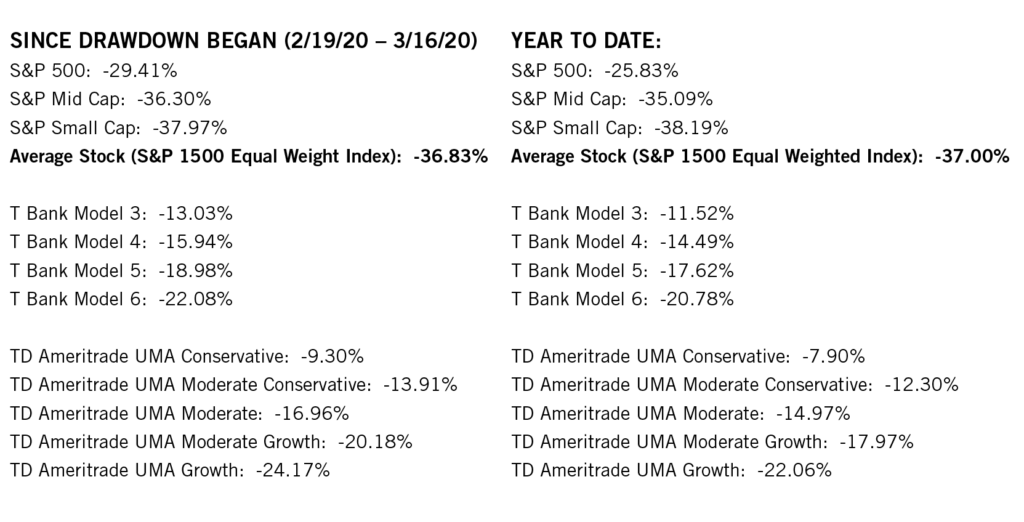

Monday, March 16, 2020, was one of the worst single days for performance in market history. Selling was indiscriminate and persistent throughout the day. The T Bank Moderate Growth Model (Model 5) captured 49% of the downside of the S&P 500 Index yesterday, and only 45% of the broader market performance as measured by the S&P 1500 Equal Weighted Index.

Year to date, T Bank Model 5 has caught about 64% of the S&P 500 decline since February 20th and has caught only 51% of the decline in the broader market. This is right in line with expectations versus the S&P 500 and above expectations versus the broader market.

Action by the CWA Investment Committee

The CWA Investment Committee met yesterday and initiated a rebalance for the Qualified Plan Models at T Bank and the UMA Models at TD Ameritrade. This rebalance will take place in the coming days. The purpose of the rebalance is to take model allocations back to their target weights. Currently, models have drifted to be below target weights for equities and above target weights for fixed income. This rebalance will effectively pull capital from the fixed income side of the allocation and reinvest it in equities. The Investment Committee is also discussing further plans of action for investment portfolios.

Volatility finished yesterday at an all-time high—much higher than even the worst parts of 2008. On days like yesterday, with volatility reflecting the amount of panic in the markets, selling is largely irrational. We would expect the market to price stocks accordingly, as the effects of the COVID-19 virus on the economy and on corporate earnings and cash flows are more well-known and understood.

In the meantime, we utilize managers that base their investment decisions on fundamental analysis precisely for market periods like this. Our managers already have a good understanding of the health of the companies they have invested in and therefore have a basis for evaluating how they can weather ongoing economic disruption.

Government Intervention

The Fed cut rates to 0 – 0.25% in an emergency move on Sunday, and also announced $700 Billion in Quantitative Easing and further liquidity programs to support the financial system. We are currently watching for a follow-up fiscal stimulus package from Congress that, in tandem with the moves by the Fed this week, could help the markets to stabilize in the near term.

Want the latest updates? Bookmark our COVID-19 Resources Page for easy access to updates and guidance from CWA and its partners.

Periodic communications may continue, however please contact your planning teams or Tectonic Advisors with any additional questions or concerns. Bookmark our COVID-19 Resources Page for easy access to updates and guidance from CWA and its partners.

Our team is here to help. Consult with a member about your situation today.

Cain Watters is a Registered Investment Advisor. Cain Watters only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. Request Form ADV Part 2A for a complete description of Cain Watters investment advisory services. Diversification does not ensure a profit and may not protect against loss in declining markets. No inference should be drawn that managed accounts will be profitable in the future or that the Manager will be able to achieve its objectives. Past performance is not an indicator of future results. All investments and strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. Historical performance returns for investment indexes and/or categories, usually do not deduct transaction and/or custodial charges or an advisory fee, which would decrease historical performance results. There are no assurances that an investor’s portfolio will match or exceed any specific benchmark. All expressions of opinion are subject to change without notice in reaction to shifting market or economic conditions.