Know the factors that impact your home budget

Recent trends in the housing market indicate that it is a fascinating time to buy a home. In August and for the first time since 2017, the market achieved double-digit year-over-year listing price growth, as reported by Realtor.com. In addition, homes are being purchased at an accelerated rate and spending less time on the market, as families seek more spacious residences due to the pandemic.

All of this means that if you’re looking for a home, you may feel the pressure to go in big and push your budget to the limit. But, is this ever a good idea, even with the unusual circumstances we find ourselves in? How can you begin to determine what to spend on a home?

Mortgage consultant Michael Addison (NMLS 603214) with CityBank Mortgage- Addison/Baldwin (NMLS 439822) has helped people buy homes for over 20 years. Together with his partner, Jessica Baldwin (NMLS 857625), they have helped hundreds of buyers sort out exactly how much they can spend when buying a home. Michael notes that it’s often hard for people to understand how much house they can afford, simply because the way lenders are required to look at income isn’t always intuitive, and can be even more complicated if the buyer is self-employed.

“Honestly, people get frustrated with the process and the paperwork. It’s like having a second job for a month or so,” explains Michael. “It’s not just your personal tax returns; it’s also your business returns, time on the job, assets, and an ever changing lending and regulatory environment. For instance, COVID has made it a requirement to have a recent P&L and balance sheet dated no more than 60 days prior to the new loan note date for all self-employed borrowers.”

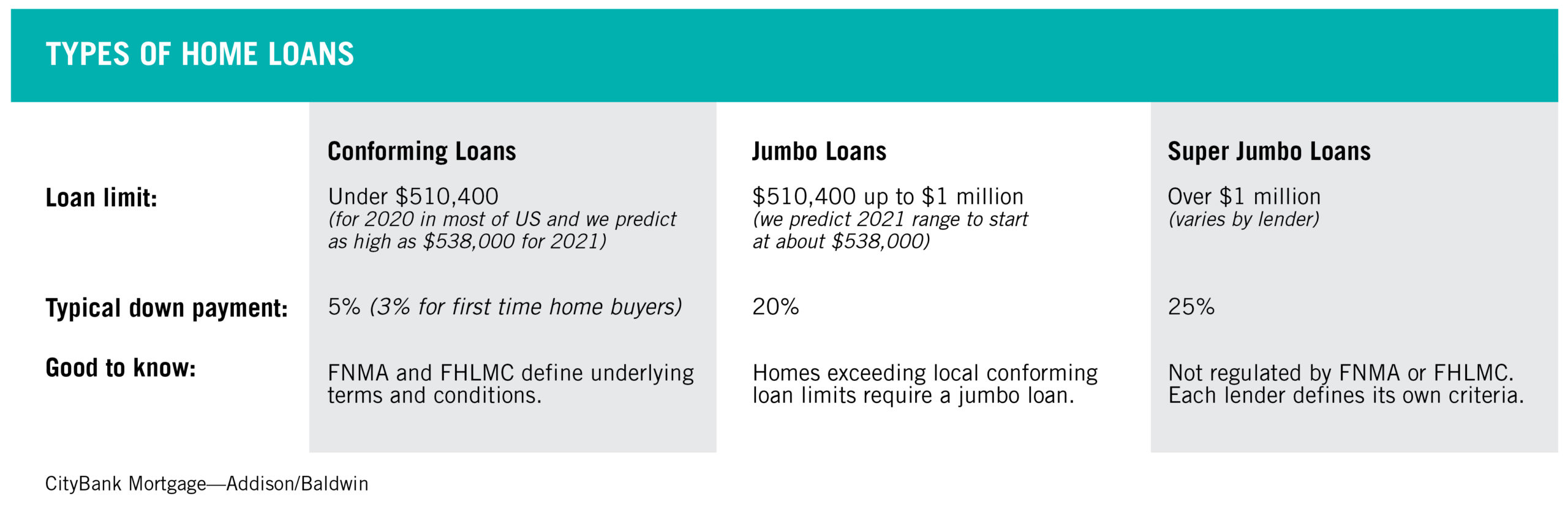

The kind of loan you qualify for will also impact your budgeting plans. Michael notes people typically choose between three kinds when buying their primary home:

Factors that impact your big picture budget

While online calculators and back of the napkin figures are good gut checks, ultimately gathering key data and documents is the right way to realistically begin to determine how much you may qualify for.

To project a budget range, Michael and his team usually begin with tax returns, a credit application, and a close look at your debt-to-income ratio. That means wrapping your head around all sources, history, and consistency of income (revenue streams, alimony, investment profits, rental earnings, etc.) and debt payments.

Know your debt-to-income ratio

Michael simply describes this ratio, also known as DTI, as your gross income versus credit expenditures per month., This should include a new house payment and associated annual property tax, homeowner’s insurance costs, HOA dues and estimated mortgage interest rate. He also notes that in recent years the government closely examined the ability to repay from a monthly debt-to-income ratio standpoint, due to the Dodd-Frank Wall Street Reform and Consumer Protection Act.

For conforming loans (<$510,401) in most cases, a 45%-50% debt-to-income ratio is the general rule of thumb. For a jumbo loan it is great to aim for 43% DTI since it is the highest ratio any borrower can have and still receive a Qualified Mortgage, as defined by federal regulations.

“Just because your debt-to-income ratio isn’t great, doesn’t mean you can’t get a loan,” encourages Michael. “Remember, a lender can’t make a good judgment without having pretty precise numbers. We’ve had cases where someone may have had a million-dollar loss on their tax return but we’ve still been able to get them a loan. There are all sorts of little nuances we can use once we have all the data. It’s like building a puzzle. You can’t finish it without every single piece. If you only have half of the pieces, you’re not going to get very far.”

Second homes and investment properties

If you are considering buying a second or vacation home, other details may impact your choices. Interest rates are nearly always the same; however, generally, the requirements for the down payment are five percent higher. Because mortgage rules differ for second homes and investment properties, if you decide to convert this home into a rental or Airbnb you may face heavy fines. State and local rules may dictate how long you can “live” in your second home before it becomes a primary residence, as well.

You don’t have to solve the puzzle alone

Sorting out your existing financial picture, calculating your DTI, and discovering the perfect down payment percentage can sound like a big task. Especially when you really just want to focus on the fun part: finding your dream home.

When it comes to starting the process, your CWA financial planner can help take the load off. They are able to advise you on not only your debt-to-income ratio, but help to get creative around how much to put down, versus using available cash to pay down debt, which can get you better terms on the interest rate.

If you seek out a mortgage consultant, look for their Nationwide Mortgage Licensing System & Registry (NMLS) number to confirm that they’re trustworthy and qualified.

“A good mortgage consultant will look at the big picture with you and your financial planner then get creative,” encourages Michael. “This is one of the reasons I enjoy working with Cain Watters. The beautiful thing is that they have all the required information we need to truly understand a client’s big financial picture. That’s really how you solve the puzzle.”

CWA can help you reach your short and long-term financial goals, from buying a new home to preparing to retirement. Contact a member of our team today for a complimentary consultation.